Political commentators have accused Gov. Pat Quinn of trying to guilt lawmakers over cuts to social service programs as he travels the state highlighting the changes that would result from the current budget.

Political commentators have accused Gov. Pat Quinn of trying to guilt lawmakers over cuts to social service programs as he travels the state highlighting the changes that would result from the current budget. But advocacy for needy and underrepresented people does not constitute a guilt trip.

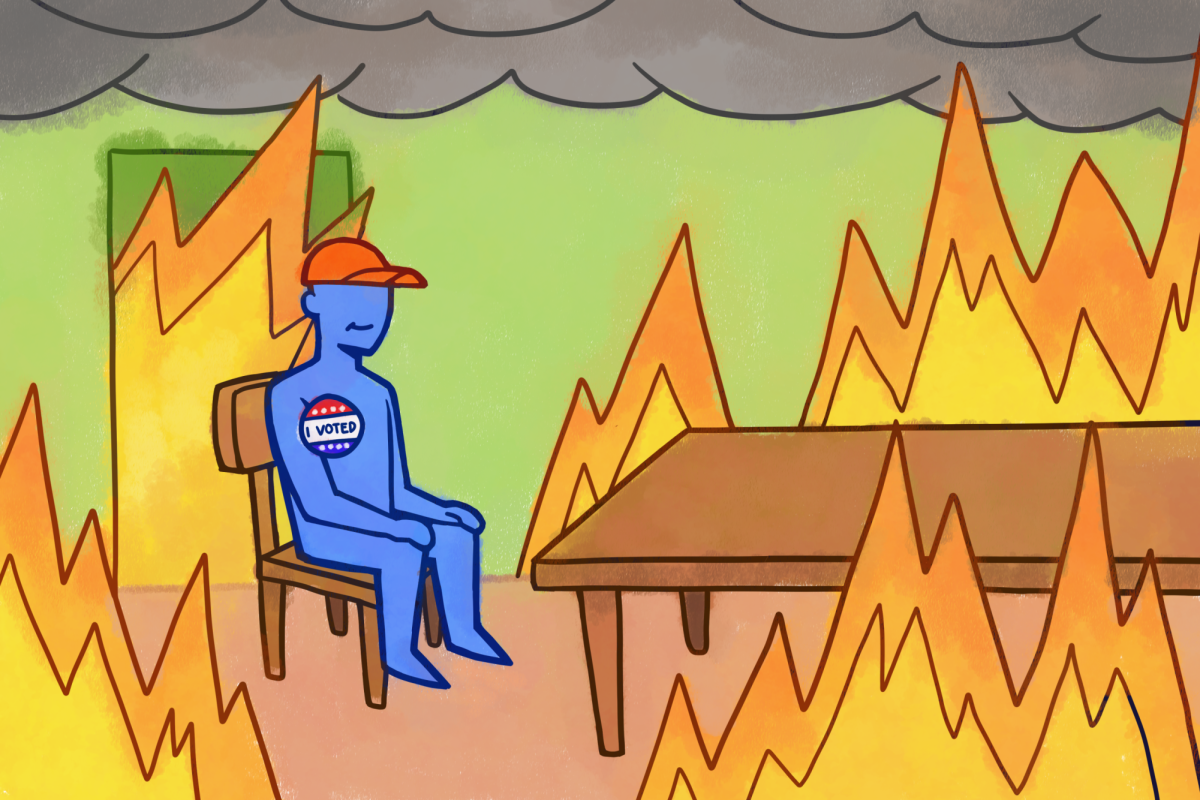

Passed at the end of May, this stopgap budget would result in $7 billion cuts across the board, including a 50 percent reduction in funding to food banks, shelters, rape crisis centers, detox facilities and other programs. State legislators and many students on this campus lead lives that are far removed from the world where people depend on these services for survival. That should not insulate us from their necessity.

This week, Quinn is meeting with legislative leaders to develop an alternative budget before the start of the new fiscal year on July 1. He argues that an income tax increase is needed to properly fund social services. A bill that would have raised the personal income tax from 3 to 4.5 percent passed the Senate but not the House during the regular session.

Legislators and other officials are the ones playing politics with this issue, as they conspicuously avoid taking a stand on a tax increase. Jesse White, Lisa Madigan and Dan Hynes have all refrained from taking a firm position on the measure. Some legislators claim that the cuts to social services can be restored without a tax increase. This argument is a smoke screen at best.

Get The Daily Illini in your inbox!

No one has stepped up with other solutions. The gap in social service funding is a serious problem that, if unresolved, will have desperate human consequences. Through a tax increase or not, legislators must take action to address them.

Unfortunately, the voices of those who will be affected by human services cuts are not heard in the halls of power. “

This notion of, if legislators don’t pass a big tax increase… the sky is going to fall . . . is just not realistic,” commented one lawmaker. For the people who will be impacted, the cuts are very realistic, however.

A patron of Eerie House, a program that receives state funding, said, “Without child care, I’d be out on the street.” The executive director of the Greater Chicago Food Depository, a food bank that is heavily reliant on state funding, described the agency’s efforts to stay afloat as “pulling a rabbit out of a hat.” “But we’re going to try like crazy to make sure that we do,” she added. Agencies that support the poor will do their part to ensure that services remain available. Now lawmakers need to do theirs.