Tracking tuition dollars: What will they fund?

Jun 30, 2023

Last updated on July 8, 2023 at 01:51 a.m.

As indicated in a report from the College Board, the average tuition at a four-year public university in the United States was $10,940 during the 2022-23 academic year.

For the 2023-24 academic year, the base tuition rate at the University will be $12,254, a 1.9% increase from 2022-23.

The base tuition rate is the absolute minimum that an in-state full-time student will be charged for their coursework at the University if they do not receive a financial aid package.

Due to college-specific fees, some students will pay considerably more than base tuition. For instance, a full-time in-state student majoring in engineering will be charged $17,348.

Get The Daily Illini in your inbox!

Despite the relative affordability of an Illinois degree when compared to private peer institutions, the education offered at the University is more costly than at the average public school.

Although it is generally understood that tuition is a student’s required contribution to the University’s budget, tracking the impact of tuition dollars may begin to explain the hefty price tag of an Illinois degree.

University budget sources

Last updated on July 8, 2023 at 01:53 a.m.

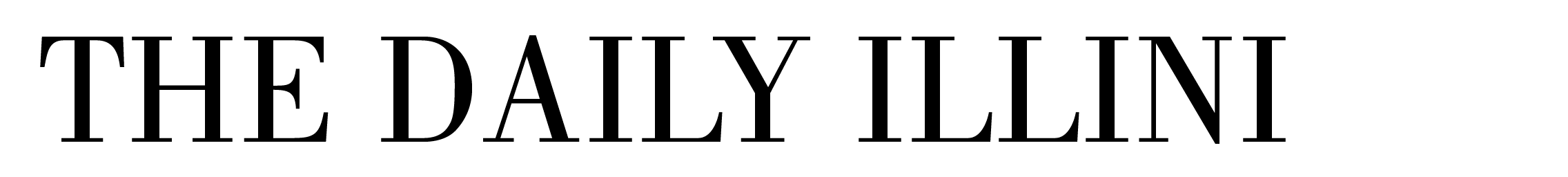

According to Vicky Gress, the University’s associate chancellor and vice provost for budget and resource planning, the institution’s budget is divided into two categories or “colors” of money: “restricted” and “unrestricted.”

Restricted income in the University’s budget includes sponsored research grants, gifts from donors and auxiliary enterprise funding. These portions of the budget are labeled as restricted because they generally have been given to the University with a specific purpose.

“When a fund source is restricted, it’s earmarked,” Gress said. “So we can’t take funding from these sources and just decide what we want to do. The sponsored research funding that we get to spend on research has to go to the projects that were proposed.”

According to Gress, while some restricted income is only intended to be used on specific projects or departments, not all of it is “earmarked.”

Get The Daily Illini in your inbox!

“While some of the gift and endowment income might technically be unrestricted, many of the dollars have donor intent attached to them,” Gress said.

Unrestricted income, which is the category that receives our tuition funds as part of the University’s “income fund,” is far less rigid in terms of its required uses.

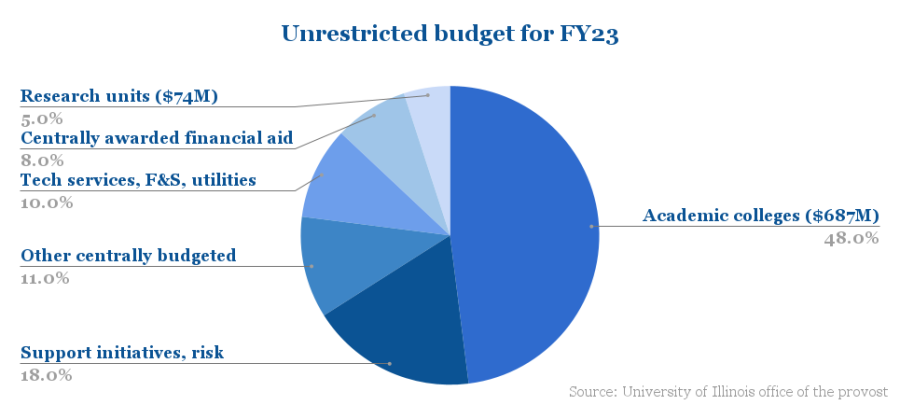

For the 2023 fiscal year, the unrestricted budget for the University totaled $1.42 billion.

Unrestricted budget

Last updated on July 8, 2023 at 01:55 a.m.

As illustrated by figures from the office of the provost, the largest portion of the University’s unrestricted budget for this fiscal year went back to academic colleges. Gress said the vast majority of this allocation went toward salaries for faculty.

Portions of the unrestricted budget also went to fund centrally awarded financial aid, technology services, Facilities & Services, utilities, campus-wide support initiatives, insurance for the University’s campus, other centrally budgeted administration costs and campus-level research units such as the Carl R. Woese Institute for Genomic Biology and the Beckman Institute.

Gress said the tuition dollars that students are charged by the University will work to support their education. This includes the out-of-state premium charges and additional funds charged by certain programs.

“The differential that nonresidents pay, we take 20% of that and flow it to the college of enrollment, but then the other 80% gets put into the (tuition) bucket with the base rate,” Gress said. “Some of the colleges have program differentials, like engineering or business — and some others across the campus. Those were requested and approved because they could make a case that it costs them more to deliver their education in those programs.”

Get The Daily Illini in your inbox!

Differential funding charged by certain colleges or programs flows directly to those entities and does not apply to the University’s budget, Gress said.

As the University’s tuition revenue has grown, Gress said that the central investment in financial aid has grown with it. She went on to say that the University projects smaller increases in financial aid spending over the next several years.

“The Illinois Commitment scholarship, which is the one where families under a base salary or income level get full tuition and fee funding for four years, started in 2020,” Gress said. “As we brought each cohort in, once the student receives the funding, they keep it the full four years. Now, there are four cohorts — freshman through senior. We’re projecting a leveling off (in financial aid costs) because … now it’s going to be four full classes that are receiving the funding.”

The Illinois Commitment scholarship is the University’s largest and most costly financial aid program.

Illinois Commitment provides full tuition and fee funding for in-state students whose family income totals less than $67,100 per year. Its introduction in 2020 contributed to a significant increase in financial aid costs for the University.

Gress indicated that there is no way to determine exactly where each base tuition dollar will go, but that the unrestricted budget figures could yield a close estimate.

“Tuition money is always going to be spent in support of the student’s education,” Gress said. “If you think about the provost’s office and the chancellor’s office and what we do, it’s really to support the education of the student. Students should rest assured that their money is going to be utilized in support of them.”