Fast-approaching Tax Day causes stress among students

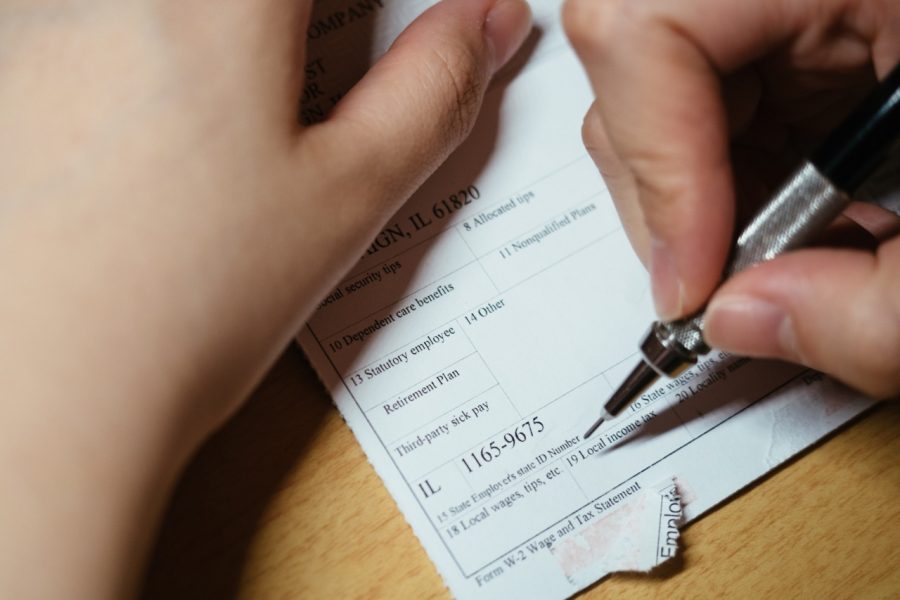

A student fills out the W-4 tax form.

Mar 8, 2017

The eight-week point of the semester can be a cause of stress for students. Seniors have to prepare for graduation and everyone has to prepare for midterms. But for students who work part-time jobs, mid-March also means the middle of tax season.

Usually, Tax Day is on April 15, but because that date falls on a Saturday, Tax Day was pushed to April 18.

Wesley Eng, sophomore in Business, volunteers for Enlightenment Industries, a local non-profit organization that provides services like tax assistance to low-income individuals and families.

In order to prepare for his job, Eng said he reviewed tax law over break and taught himself how to do taxes.

Enlightenment Industries uses a program called Tax Slayer, which is similar to TurboTax.

Get The Daily Illini in your inbox!

To begin, the client fills out a quality interview sheet with their family background. They have to bring in forms with information such as wage income, deductions, healthcare and other financial information.

The next step involves inputting the information into the tax software. The software calculates the credits and deductions that the tax payer needs to know.

“The client comes with me to an office space; I’ll plug in the information the client gives me into the tax software. The tax software gives you everything, like the different types of credits there are and the deductions,” Eng said.

Once the volunteer accountant, like Eng, is finished with the entire process, a supervisor does a quality review to ensure that all the information is correct and was inputted properly.

The final step is to tell the State of Illinois the client’s bank account number and routing number so they can receive a direct deposit of their refund.

Ivy Fishman, senior in LAS, said her mom does her taxes for her since her mom is an accountant, so Fishman does not have to worry about them each year.

However, not every student has a parent who is an accountant.

Stephany Burz, junior in LAS, said she is worried about doing taxes this year as she has never done them before. Burz is making her boyfriend file her return since he has previous experience with taxes.

Regardless if students are in a situation like Burz or Fishman, there are services and software available that simplify the tax return process.

Tax software, like TurboTax, can help students file their tax returns. TurboTax offers a free federal and state tax edition. Software programs like this walk the users through each step and break down the process.

To begin, students create an account. The online software then asks for basic personal information like the filer’s name, marital status, zip code and financial information.

The next part involves inputting any income information the filer may have such as a W-2 or interest on a bank account.

Throughout the entire process, the software asks questions that can determine how many credits the filer receives.

Students have potential tax breaks from paying tuition, having loans and attending school full time.

The software informs the user of what kind of deduction they have.

There is an “other” section where the user can fill out any other forms they might have information for to qualify for the largest refund.

After all the paperwork is filled out, the system checks everything over and determines the federal refund size.

Students are also required to pay their state taxes. After completing the federal section, the state taxes are almost finished as the user has input most of the information into the program already.

The system asks a similar series of questions and offers another section where the user can opt to fill out other income sections if applicable.

The program asks if the user qualifies for any of the Illinois credits and tax breaks because they can receive a larger return by claiming some of them.

Once again, the software checks the form over and calculates the refund amount.

The system asks the user to do a final review before they send the return off to the state and federal governments.

Before the software can file, the user must input their registration information again and verify it for safety.

The program tells the user which way is the best to file their information. If an e-file is an option, the process is built into the software. For a mail-in return, the user has to print the file and mail it to the proper office.

Although taxes pose potential worry to student workers, tax software can alleviate some of the stress by making the process simpler.