House bill proposes to help collegiate housing improvements

Mar 20, 2014

Last updated on May 11, 2016 at 06:02 a.m.

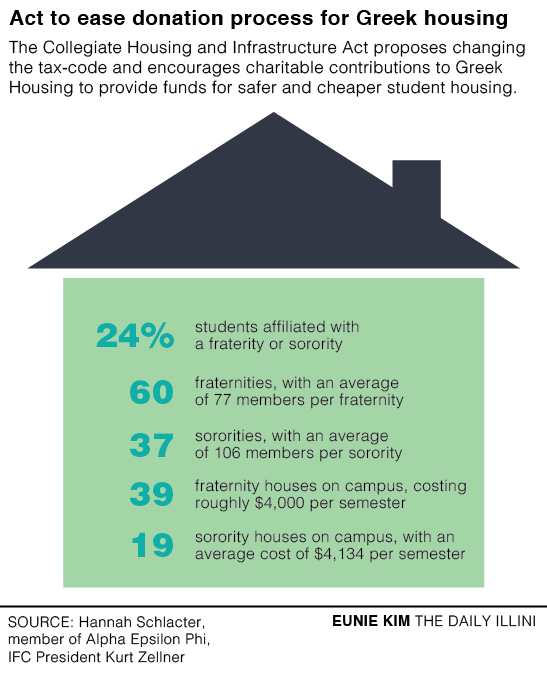

Last semester, a female student fell off a fire escape at a fraternity house during a party, but there isn’t enough money to make necessary safey improvements within nonprofit housing to prevent accidents like this, said a proponent of the Collegiate Housing and Infrastructure Act.

The act aims to address safety and other issues by changing the federal tax code to allow tax-exempt donations for organizations such as fraternities, sororities, Hillel or Chabad, to make housing or infrastructure improvements to off-campus collegiate housing.

“A lot of people don’t realize how much it costs to make infrastructure and safety improvements to these houses because lots of sorority and fraternity houses are hundreds of years old,” said Matt Hill, Illinois student senator, supporter of the act and sophomore in LAS. “When you add up that cost of installing a new sprinkler system, it becomes very expensive in addition to the taxes.”

Kurt Zellner, president of the University’s Interfraternity Council, believes the bill could reduce the cost of living in Greek houses, depending on the impact of the tax-deductible donation.

Get The Daily Illini in your inbox!

“I think from the fraternity perspective, a lot of houses who get more donations think about expanding how they can better the houses, whether it’s for safety, aesthetic reasons, expanding the house so more people can live in or cutting the cost of housing,” Zellner said. “Anytime you can make it more incentivized for guys to live in the house that’s a great positive. Brotherhood is built from living together.”

Hannah Schlacter, member of Alpha Epsilon Phi, will join several fraternity and sorority chapters to head to Washington, D.C. to lobby for the act from April 27 to May 1.

“I’m looking forward to traveling to D.C.,” said Schlacter, freshman in business. “This is something I am passionate about and I’ve had a wonderful experience. I look forward to living in the house next year and I want to give other people this opportunity.”

The Fraternal Government Relations Coalition, a Greek lobbying organization, plans lobbying visits every year.

“This will help students because it will make housing safer for them and more affordable for them,” Schlacter said. “In terms of safety, I know that there was a lot of emphasis on fire sprinklers and fire escapes.”

According to the Fraternal Government Relations Coalition, only 50 percent of fraternity housing has fire sprinklers, and since 2000, 80 percent of fatalities in student housing fires have occurred in off-campus housing. Retrofitting for fire sprinklers can cost up to $400,000.

“With a lot of older houses, and currently with my fraternity renovating our new house, the sprinkler system and the fire escape can be very expensive,” Zellner said. “The fire systems are a very important part of the house and a very costly one to maintain.”

Additionally, room and board costs outweigh tuition costs at most public universities, and more than 250,000 students nationwide live in nonprofit housing, according to the Fraternal Government Relations Coalition. Nationwide, the Greek community has identified over $1 billion in capital improvement projects.

Zellner said that Greek houses typically cost more than an apartment, but less than living in dorms. In comparison to apartments, students get the amenities of living with friends, common areas and a food service. Compared to dorms, Greek housing has more space, and the option to chose who you live with not only on the basis of a bedroom, but the entire house.

“It’s encouraging to be around people with similar values to your own and that experience is priceless in itself,” Zellner said.

The federal act, cosponsored by Rep. Rodney Davis, R-13, and Rep. Adam Kinzinger, R-16, amends the Internal Revenue Code of 1986 and currently stands in the House of Representatives.

Zellner believes that the act would serve as another incentive for alumni or a fraternity member’s family to donate. Currently, people can make tax-exempt donations if they are for academic reasons, such as adding a study room in the house.

“For the people on the edge considering whether to donate, this may be the driving factor to make them more willing,” Zellner said. “Having looked at some of the data of the lost tax revenue, it isn’t a sizeable amount that we’re making a negative impact in that regard.”

The Illinois Student Senate is considering a resolution that supports the act, which Hill sponsored. The senate will vote on the resolution at the senate’s April 2 meeting.

“A resolution is a really good tool to use when you lobby,” Hill said. “It’s a formal and more legitimate way to demonstrate to a legislature that the student government, who represents the student body, supports this.”

Megan can be reached at [email protected] and @MeganAsh_Jones.