University student loan default rate far below national average

Oct 7, 2014

Last updated on May 11, 2016 at 01:39 a.m.

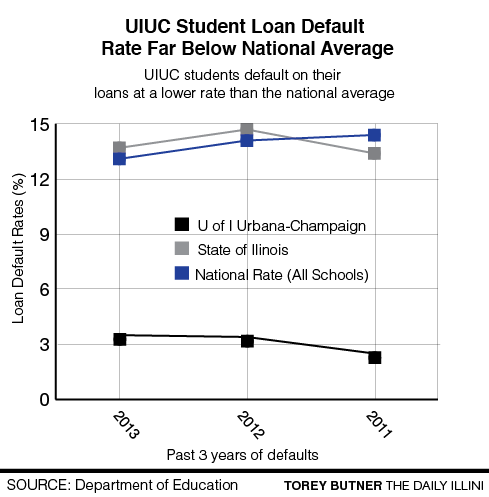

The national default rate on student loans for borrowers in their third year of payment decreased between 2012 and 2013 from 14.7 percent to 13.7 percent.

For University students, this rate was far lower. In 2013, the rate of default on student loans for borrowers in their third year was just 3.4 percent, significantly lower than the national rate.

Among Illinois public four-year universities in 2013, the University of Illinois had the lowest rate of default for borrowers in their third year of payment, followed by the University of Illinois at Chicago, whose 2013 default rate was 4.2 percent.

Director of Student Financial Aid Dan Mann said that a number of factors likely contributed to the low rate of default.

Get The Daily Illini in your inbox!

“Our students are graduating and getting jobs, so they have the ability to pay their student loans,” Mann said. “We have been able to increase and provide more aid as well as expand the group that is getting some need-based aid a little bit because of the additional dollars that is being put in.”

Research conducted by the Department of Financial Aid painted a clear picture of a typical student that has to default on their loans.

“That profile seemed to be students who may have come one year or maybe two years, dropped out, probably didn’t have a job when they dropped out and didn’t repay their student loans,” Mann said of the data. “The big thing that we really found was whether or not you got a degree or not seemed to be a big factor.”

In a study of 5,287 University students, 191 defaulted; of those students, 85 percent were undergraduate students and 53 percent did not receive a degree. Half of the students that defaulted did so for less than $10,000 worth of debt, according to Mann.

Brandon Hudspeth, senior in LAS, receives need-based aid from the University and says that while he is grateful for the financial assistance he receives, he recognizes that not every student is as fortunate as he is.

“I’m one of the lucky ones,” said Hudspeth, whose tuition is entirely covered by the financial aid he receives. “But then again, if it weren’t for financial aid I wouldn’t be going here.”

While the University’s student loan default rate is far below the national average, it is the most expensive public university in the Big Ten for in-state residents with tuition and housing expenses totaling more than $30,000.

University law school graduate Anthony Fiorentino, who started the University’s Student Debt Committee last year, said that while the committee’s biggest achievement was successfully getting both chambers of the Illinois legislature to pass a resolution that calls for Congress to restore bankruptcy protection for student loans, the current Congress does not have the best interest of America’s students at heart.

“They’re not interested in making these reforms because the current Congress we have are advocating only for the interests of the banking institutions and the financial institutions who lobbied to get these laws in the first place,” Fiorentino said.

He added that without meaningful reform to student loan law, this current generation of students could be facing a bleak economy in the future.

“What happens is our economy, first of all, is going to continue to slide because younger generations are spending less money: they are living more off of debt, they’re not able to buy cars, they’re not able to buy homes,” Fiorentino said. “All the money that previous generations were putting into retirement, you’re going to be putting into student loans.”

Josh can be reached at [email protected].