Amazon begins collecting sales tax in Illinois

Feb 3, 2015

Last updated on May 10, 2016 at 10:20 p.m.

As of Sunday, the online retailer Amazon has begun charging sales tax in Illinois for the first time. The new tax comes after a state law effective Feb. 1, aiming to collect equal sales tax from online and physical retailers.

While Amazon does not yet have warehouses or facilities in Illinois, the company was given one month to comply with the recent affiliate nexus law, which counts a company’s in-state sale affiliates as a physical presence.

However, Amazon will also soon begin establishing itself physically with the creation of roughly 1,000 jobs and an investment of $75 million by 2017. The current Illinois sales tax rate of 6.25 percent will be required of the company whether or not it follows through on plans to develop the facilities.

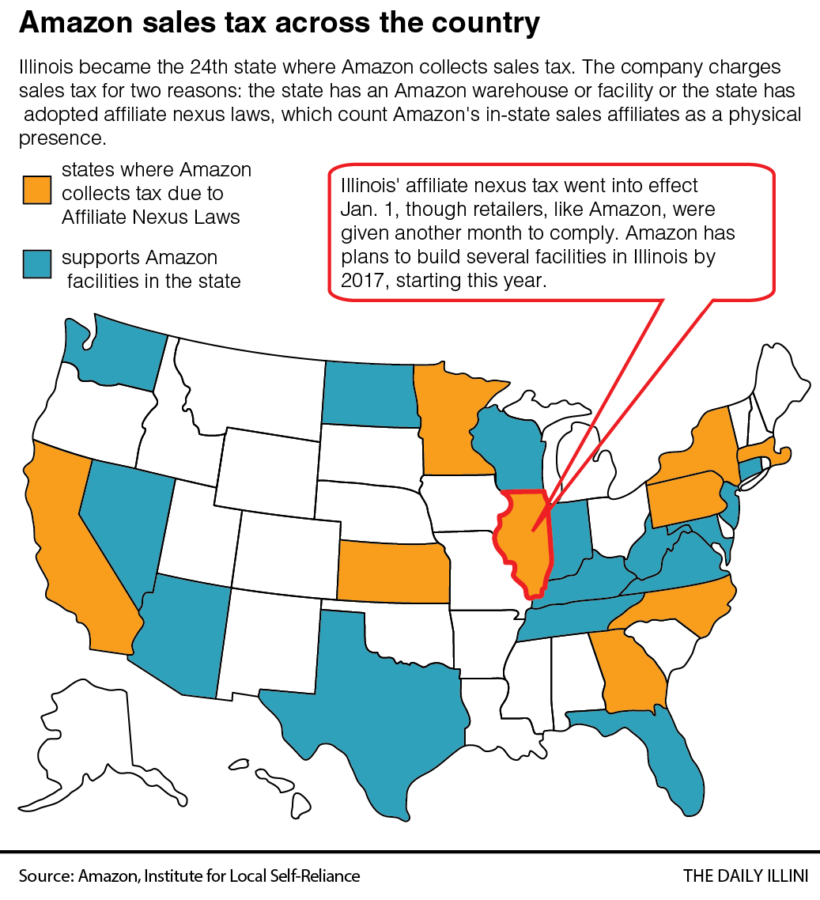

Illinois is the 24th state where items sold by Amazon or its subsidiaries are subject to sales tax.

Get The Daily Illini in your inbox!

Rob Karr, president of the Illinois Retail Merchants Association, believes the act of Amazon collecting sales tax in Illinois is a step in the right direction.

“We believe that online sellers, just like competitors that are brick and mortar, should collect and remit the sales tax from the consumer,” Karr said. “If they don’t — which many of them do not — then the consumer is on the hook to pay the tax.”

The issue of whether Amazon collects sales tax in a specific state is largely determined by the company’s physical presence. Amazon currently charges sales tax in the states where their warehouses and facilities are located.

Even if Amazon does not collect sales tax on remote purchases, the customers would still have to pay that tax on their income tax return, said Terry Horstman, public information officer for the Illinois Department of Revenue.

“If the retailer does not have enough contacts to be a tax collector for the Department of Revenue, the customer will still incur that use tax, but be required to remit that to the department,” said Horstman. “And that usually occurs yearly on their income tax return.”

Amazon, currently one of the top 10 retailers in the country according to the National Retail Federation, has become a common resource used by students looking to buy textbooks, school supplies and other campus necessities.

Despite the additional cost, Malachi Raley, freshman in Engineering, doesn’t believe the sales tax charges will have a major effect on students purchasing from Amazon. He uses Amazon mainly to purchase books and other recreational items he can’t find in the area. For him, the retailer’s advantages overshadow the additional costs.

“It’s not really that big of a tax, and also Amazon has options for free shipping,” he said.

According to Amazon, the amount of tax charged on a specific order often depends on a variety of factors, such as the seller, type of item purchased and shipment destination.

Karr hopes the company collecting sales tax in an increasing number of states will help move the issue forward to federal legislation that would compel all online sellers to collect and remit taxes.

In May 2013, the U.S. Senate voted to approve the Marketplace Fairness Act, which is still being debated by Congress. If approved, it would enable state governments to require the collection of sales tax by out-of-state retailers, even if the company has no physical presence in the state.

“I think any time you have a major player like Amazon agreeing to collect and remit the tax, it helps with other similarly situated economic actors,” Karr said.

Camille can be reached at [email protected]