Republicans propose to freeze Pell grant funding

Apr 1, 2015

Last updated on May 10, 2016 at 08:00 p.m.

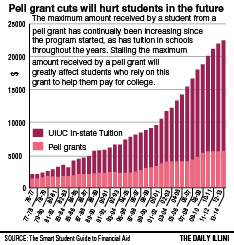

Republicans looking to balance the federal budget have proposed a resolution that would freeze the Pell grant at its current maximum amount of $5,775 for the next 10 years.

According to the U.S. Department of Education, Pell grants are federal grants that, unlike a loan, do not have to be repaid. The amount a student can receive depends on their financial need, the cost to attend college, their status as either a part or full time student and whether or not the student plans to attend school for a full academic year.

With college tuition rising each year, this freeze will negatively impact students who rely on Pell grants to afford college, said Brexton Isaacs president of the College Democrats of Illinois.

“The cost of college is rising and the level of assistance will stay stagnant over the next decade, which will hurt students because its not like the cost of college is going to stop increasing,” said Isaacs. “It’s going to make it harder and harder for students to afford education and put students in more and more debt when I think we should look at ways to make college more affordable.”

Get The Daily Illini in your inbox!

However, Charles Mayfield, the associate director of student financial aid said this proposal is only the beginning of the process.

“An important thing to remember in the budget proposal process is that it’s the first of many steps,” said Mayfield. “The President, in his proposed budget, suggested a Pell grant amount for next year with a maximum award of $5,915, but again, those proposals are the first of many steps in the federal budget process.”

The Institute for College Access & Success’ report on Pell grants said students with financial need are eligible to receive a Pell grant if their family income is below $50,000. However, most grants are awarded to students’ from households with an average income of less than $20,000. Students receive less grant money if they are part-time, attend a college with a low tuition rate or have a family income on the higher end of the range, according to the report. The maximum grant only covers less than one third of tuition at a four-year public college.

In the 2013-2014 school year, 6,888 students benefited from Pell grants said Mayfield, and 72% of the student body received financial aid of some kind.

Students who receive Pell grants are more than twice as likely to have loans and the average debt for recipients is $4,750 higher than other, higher-income students.

Mitch Dickey, student body president, said the Pell grant freeze will impact a student’s ability to achieve a higher education.

“You’re going to have less and less money available to students in need from the federal government that can go to paying off their schooling,” Dickey said. “Students are either going to have to one, not even go to school in the first place, because its too expensive or two, they’re going to have to take on more loan debt — even more loan debt than they currently do.”

Mayfield said the average debt of seniors who borrowed money in the University is $23,808.

“The cost of college has increased, the amount of debt has increased, student loan debt has surpassed credit card debt in our country, and I think that we need a new solution,” Isaacs said. “I don’t think lowering access to assistance for students is going to fix the problem.”

Proposed act could help students refinance loans

Congresswoman Cheri Bustos, D-17, introduced the Bank on Students Emergency Loan Refinancing Act, allowing students with high interest rates to refinance their loans at a lesser rate.

The act will save the average student borrower around $2,000 on their college loan, said Brexton Isaacs, president of the College Democrats of Illinois. He said it is a step toward making college more affordable and could reduce student debt.

“Democrats recognize the effects that long-term debt has on people and how it can negatively affect ones ability to succeed and do well,” Isaacs said. “When people have less debt and aren’t burdened by debt, they’re going to be better members of our economy.”

The same legislation was introduced in the U.S Senate by Massachusetts Sen. Elizabeth Warren and Illinois Sen. Dick Durbin, according to a press release from Bustos.

Student Body President Mitch Dickey said the republican party is making it harder for students to afford college, referring to the Pell grant freeze as an example. However, he said he is grateful to democrats for their efforts to make higher education more accessible.

“You’ve got champions like Elizabeth Warren and Dick Durbin, who have been fighting on the converse for students, so we’re really lucky in Illinois to have Dick Durbin as one of our representatives because he’s been really great on these issues,” Dickey said.