Students spending habits call for early credit-building

Source: Creditcards.com

Mar 26, 2018

Last updated on Oct. 22, 2021 at 12:17 a.m.

While most students reach for debit cards as their favored method of payment, a study shows this preference may lead to greater costs in the long run.

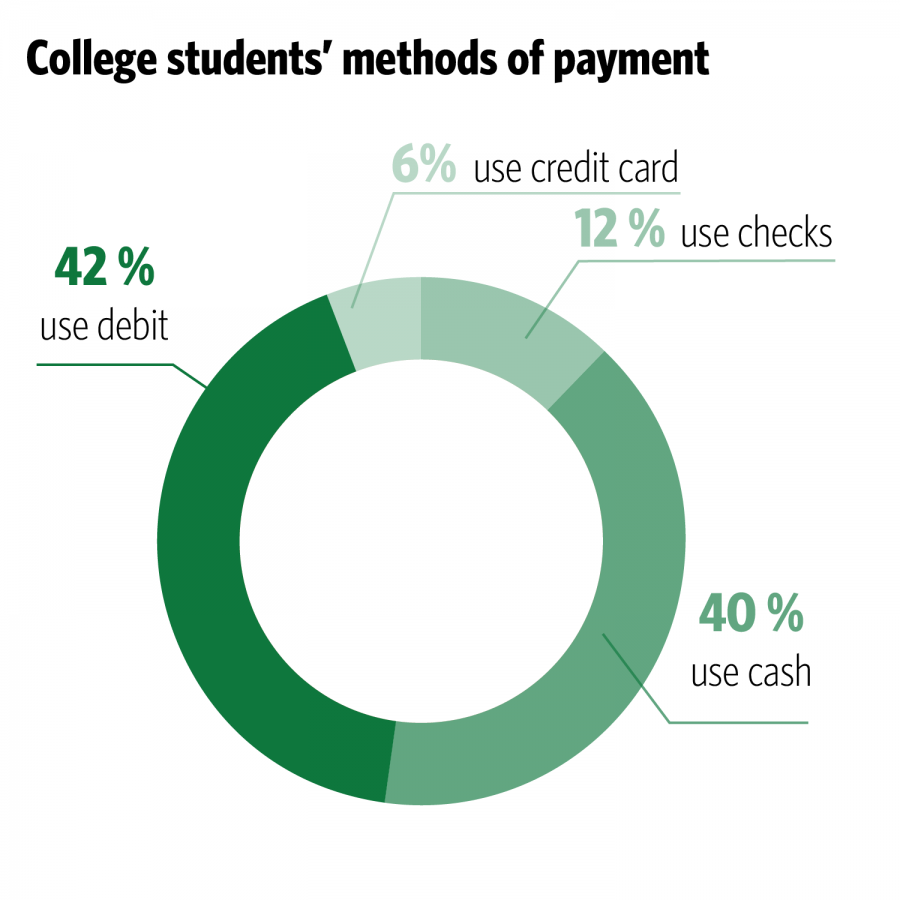

According to a study done by Student Monitor Financial Services, credit cards only pay for 6 percent of college student spending. Meanwhile, debit cards pay for 42 percent of spending.

Student Monitor also found only 23 percent of college students have a credit card registered in their name.

Specialty cards such as Comenity credit cards are also used to develop a credit history, which is essential for things like getting approval for a mortgage or auto loan or renting an apartment, said Jake Lunduski, director of community outreach at Credit Card Insider.

Get The Daily Illini in your inbox!

Credit history can also come into consideration when getting insurance coverage, getting smartphone service and even finding employment, Lunduski said.

“By understanding how to build credit early in life, students can build a good foundation to be able to get better terms on loans in the future,” he said.

Although it is suggested to start developing credit early, college students choose not to get a credit card for a variety of reasons, Lunduski said.

He said some students may choose not to use a credit card to avoid the temptation of spending more money than they have, and students may feel getting a credit card will cost them more in the long run from possible additional costs and interest.

“Students who are disciplined enough to only purchase on a credit card what they’ll be able to pay off in full each month could definitely benefit from shifting spending to a credit card,” he said.

Lunduski said students should start building credit as soon as possible. Credit scores take into account the length of time your oldest account has been open, so it is better to start sooner rather than later to maximize that duration, he said.

Jade Hessee, sopho-more in ACES, said she began building a credit score because her parents said it would be a good idea.

Hessee recently activated a credit card and is just beginning to develop credit. Although her decision to start building credit history was partly her parents’ idea, she said the decision was important in growing up and gaining her independence as an adult.

“When I become a real adult and make big purchases I want to show that I have good credit to be able to buy them,” Hessee said.

okw2@dailyillini.com