UI insures against drop in Chinese enrollment

Source: Jeffrey Brown, dean of the Gies College of Business

Dec 10, 2018

The Gies College of Business and the College of Engineering have become the first colleges on any university campus to purchase insurance to protect themselves from a potential drop in Chinese student enrollment.

The University has agreed to pay $425,000 per year to an insurance company for up to $60 million in coverage to protect against factors outside of the colleges’ control, which could contribute to a decline in Chinese student enrollment, said Jeffrey Brown, dean of the Gies College of Business, in an email.

The insurance payoff will take effect if enrollment drops by 18.5 percent in a year due to causes such as visa restrictions, trade wars or a major public health event, Brown said.

The colleges entered the contract in 2017, which gives them coverage until 2020. Brown said the policy can be canceled at any time.

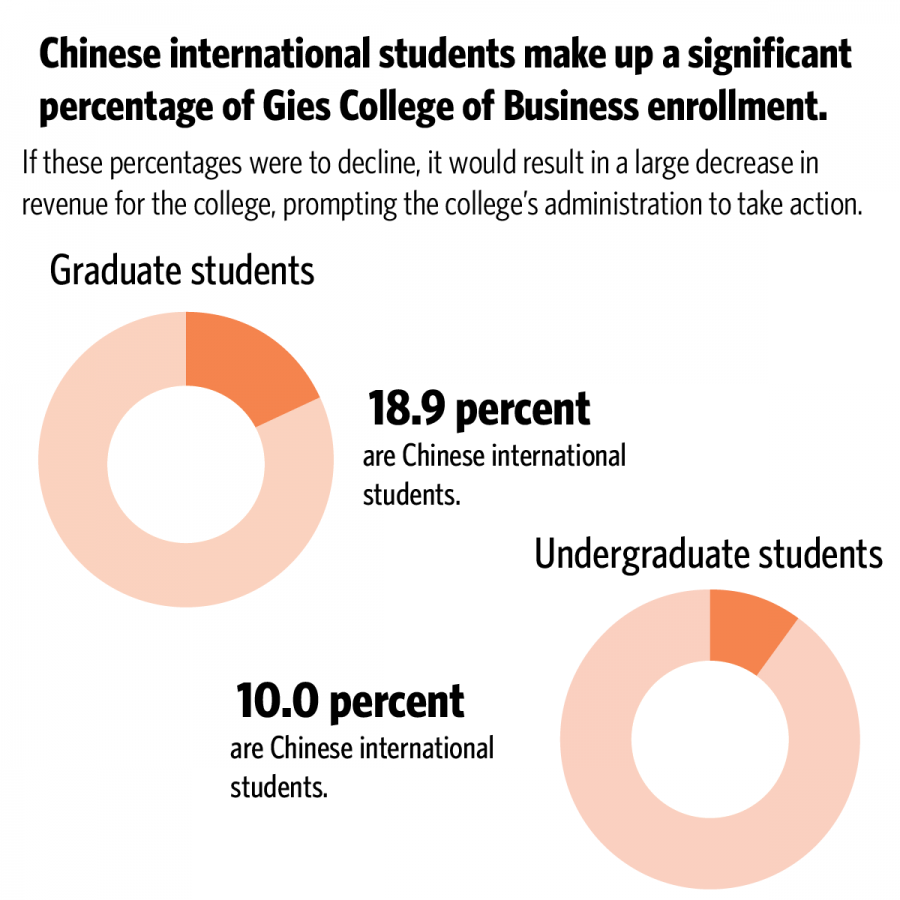

Currently, over 800 students from China are enrolled in the Gies College of Business. They make up 18 percent of graduate students and 10 percent of undergraduates, Brown said.

Get The Daily Illini in your inbox!

“Students from China represent a significant source of revenue for the colleges, and this insurance would keep us whole in the event of a temporary shock,” Brown said. “In simple terms, it buys us time to respond strategically.”

Brown, who has a background in risk management, said he thought it would be in the college’s best interest to pursue an insurance contract, and two professors from the college started leading this effort shortly after he became dean in 2015.

“The geopolitical climate is constantly changing – for better or for worse – and there will always be factors out of our control that can affect us tremendously,” Brown said.

Jennifer Delaney, professor in Education, said an event that would influence the number of international students enrolling in the University could be the Trump administration’s trade war with China.

“If President Trump’s trade war with China makes fewer students come to the University, we don’t have a lot that we can do to influence the trade war, so that could have a real impact on the University,” Delaney said.

Delaney said universities are already seeing increased restrictions on visas for international students, so that will make students less likely to study in the United States compared with other nations.

Other events from earlier this year suggest the future of international student enrollment, especially Chinese student enrollment, may be on shaky ground.

President Trump was urged by Stephen Miller, White House aide, to end all Chinese international student visas, but the proposal was later dropped due to the potential economic impact, the Financial Times reported.

Reuters, an online news organization, recently reported the Trump administration is considering further restrictions on Chinese students, such as checks on students’ phone records and social media platforms for anything that could raise concerns about their intentions toward the United States.

Delaney said whether or not other institutions will follow in the business and engineering colleges’ footsteps is dependent on the population of the institution.

“My guess is we will only see other institutions interested in something like a policy on international student enrollment levels, if they have really large international student enrollment levels,” Delaney said.

Delaney said the University is rather unique in terms of how large the international student population is and how essential it is to the University’s revenue stream, so there might not be many other colleges that find the need to take a step like purchasing insurance.

Despite any risks that may crop up in association with international student enrollment in the future, Brown said this will not stop colleges from investing in international student education.

“While we have this insurance policy, we will continue to ramp up our investment in and recruiting efforts toward maintaining a robust international student population, including China,” Brown said.