Virtual spending creates appearance of unlimited funds

Apr 24, 2019

Everyone’s heard the phrase “more money, more problems.” But in this digital day and age, it seems more appropriate to change the saying to “more money, what problems?” Spending has never been easier than today, and this attitude toward money is the result of a new wave idea: virtual spending through apps.

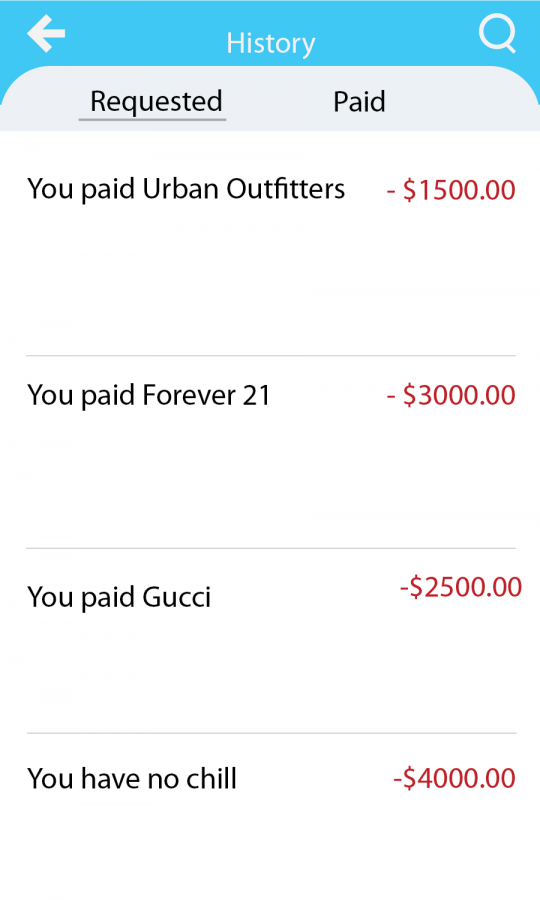

The monetary transaction is virtually nonexistent with the use of an app as the main vehicle to spend your money. Unlike with a credit card or cash, we don’t feel anything physically leaving our hands to signify a transaction occurred; we simply tap our finger and money is suddenly taken from our bank accounts. We don’t feel a sense of loss.

It’s much easier to click or tap a few buttons than it is to dig through a bag, locate your wallet and then pull out a card or cash.

This ease of spending has made it more convenient for people to shop and spend, but it’s become so easy that people aren’t keeping track of how much they’re spending. Now, people are more likely to buy things on a whim without considering whether they should make that purchase.

The problem is spending through virtual apps is intangible; we’re far removed enough from the process that we feel like we didn’t really spend anything at all. Conceptually, people understand they’re still losing money, but the effect isn’t the same because people can only virtually imagine a drop in their bank account.

Get The Daily Illini in your inbox!

In general, Venmo and Apple Wallet are very convenient to use in cases where money needs to be transferred quickly between individuals, but people need to be cautious of how often they use this method of payment. Even Amazon has introduced a “1-click ordering” button intended to shorten shopping time and be more effective.

Spending money today has never been easier or more convenient. And with that great power comes great responsibility. Controlling and planning how much one spends has always been an important lesson in learning how to be an adult, and that cannot be truer for today.

It’s easier to spend money when you’re not faced with the depleting bills in your wallet or the consecutive times you’ve swiped your credit cards; these methods actually help self-regulate spending. Take that away and replace it with a click or a tap of a finger, and spending increases tenfold. But the amount of money in your wallet, virtual or otherwise, remains the same.

Whatever anyone wants to spend their money on is their prerogative, but they can’t lose their self-control in the path to self-indulgence. With the advent of virtual spending apps, it’s become harder and harder to visualize money physically leaving our hands, making it easier and easier to spend it. This means we’re losing money at a faster pace even if we don’t realize it yet, so it’s sometimes more important for us to reel it in than to spend it all.

Alice is a freshman in LAS.