US deficit suggests impending economic avalanche

Photo Courtesy of Tribune News Service

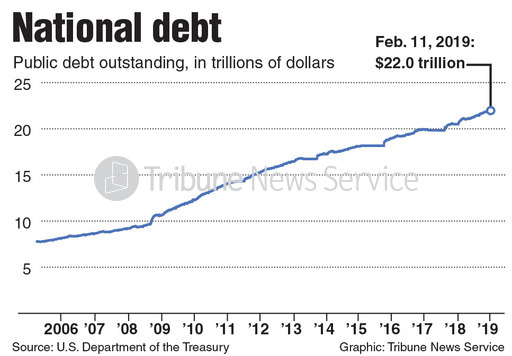

Chart of the U.S. national debt.

Feb 20, 2019

As many of the world economies teeter on the brink of a recession, the richest economy in the world is flirting with stagflation — growing inflation without economic growth — and a trillion-dollar national debt that threatens the global economic expansion.

Due to recent tax cuts, military spending and budget conflicts between Democrats and Republicans, Donald Trump’s American economy is heading toward an “extremely imbalanced” path, according to former Federal Reserve Chairman Alan Greenspan.

The tax cuts that were supposed to reignite the economy and create government revenue through taxes were widely ineffective and have only grown a debt that must somehow be paid off. As the national debt swells closer to $1 trillion just as the economy reaches its peak, the nation must rethink its response to handling the immense liability.

Budget deficits are created when government expenditures exceed government revenue. When the government revenue is under pressure, the government will utilize their fiscal policy measures to counteract the deficit through tax rate increases. The United States has never defaulted on its debt.

The current problem at hand for the United States — and the globe — is not inherently the large budget deficit. The problem lies in the fact budget deficits lead to inflation as taxes must go up because the deficit must be paid off.

Get The Daily Illini in your inbox!

Inflation isn’t inherently bad, but poses an immense risk at the end of an economic boom and the beginning of a potential recession. In 2009 after the Great Recession, the budget deficit swelled to a massive $1.4 trillion. However, the world would not have recovered as quickly as it did without the bailouts and government spending that led to the deficit.

This deficit saved thousands of lives, jobs and income streams.

Now, the first signs of a recession are evident as global companies are reporting poor projections for future earnings while China and the European Union are showing clear signs of economic headwinds. In other words, the world is explicitly telling us the economic boom is reaching its grand finale.

The current deficit has been caused by the Federal Reserve not raising rates enough during a healthy economy and greedy political decisions designed to brainwash voters into feeling richer than they actually are. News flash people, the tax cuts weren’t free money!

See the difference between the two massive deficits? One occurred because of stimulus procedures to revive a dead economy with massive unemployment rates and was effective in bringing back a damaged world. The other has been created at a time when unemployment remains at a record low and the global market makes its final ascent toward the economic peak.

Although unemployment rates remain low, a global economic slowdown — which is becoming more possible by the day — would cause them to rise. Rising unemployment rates alongside higher taxes and lower growth would be detrimental to the economy and cause inevitable inflation in the form of stagflation.

Stagflation is an unfortunate economic occurrence caused by higher prices, sometimes influenced by increasing taxes, as the government tries desperately to pay off its debt. Also occurring are high unemployment rates and low productivity. The taxes hurt competition, producers are forced to raise prices and the dollar is worth less at a time when most people don’t have many dollars in the first place.

The producers in the economy experience an increased cost through increased taxes, which makes producing difficult. And of course, the producer doesn’t incur the cost alone and is able to pass it to the consumer by adding the increased cost of production into the selling price.

This issue was solved as the Federal Reserve reduced rates on 30 year treasury bonds from 5.3 percent to 2.25 percent between 2008 and 2009 to stimulate the economy. This significant reduction allowed the crisis economy to revive quicker which thus reduced the threat of stagflation and fueled the tax revenue necessary to pay the debt.

But now, despite recent interest rate increases, the interest rates remain very low. So as a result, in the event of a recession, the government would be unable to drop rates enough to make a difference in the economic recovery. And because of the massive deficit forming before a recession, there would be effectively nothing the government could do to stimulate the economic growth and revenue necessary to pay off the deficit.

It would be nice if President Trump finally utilized his economics degree from the world’s premier business school to tone down erratic spending. If the president has the ability to step down from his pedestal, admit the tax cuts failed and address the debt rather than a wall, the global economy will endure a far less painful adventure down the economic mountain.

Fred is a freshman in Media.