The digital gaming industry has evolved rapidly over the past decade, not only in terms of graphics, gameplay, and accessibility, but also in how players fund their entertainment. One of the most notable shifts has been the growing adoption of prepaid payment solutions, particularly in online gaming and casino environments. These methods are changing how players think about spending, privacy, and financial control in digital spaces.

As gaming becomes more integrated into everyday digital life, payment preferences are shifting accordingly. Players are no longer satisfied with one-size-fits-all banking options. Instead, they are gravitating toward prepaid solutions that offer flexibility, simplicity, and a greater sense of autonomy.

From Cards to Prepaid: Why Payment Habits Are Changing

For years, credit and debit cards dominated online gaming payments. They were convenient and widely accepted, but they also came with drawbacks. Entering card details repeatedly, dealing with declined transactions, and worrying about data exposure have made many players rethink how they pay online.

At the same time, increased awareness around digital security and responsible spending has encouraged players to seek alternatives. Prepaid payment solutions address many of these concerns by removing the direct link between gaming platforms and primary bank

accounts.

Instead of relying on post-paid credit or open-ended card limits, prepaid methods allow players to decide in advance how much they want to spend. This shift represents a broader change in mindset, where control and transparency matter as much as convenience.

Get The Daily Illini in your inbox!

What Are Prepaid Payment Solutions?

Prepaid payment solutions allow users to load a fixed amount of money onto a voucher, card, or digital balance before using it online. Once the balance is exhausted, no further spending is possible unless the user tops up again.

In digital gaming, this structure is particularly appealing. Players can fund accounts without sharing bank or card information, making prepaid options feel closer to cash than traditional electronic payments.

Among the most recognized prepaid solutions in online gaming is Paysafecard, which has become a staple across many international casino platforms.

Paysafecard and Its Role in Digital Gaming

Paysafecard operates on a simple premise: players purchase a prepaid voucher and use a PIN to pay online. No bank login, no card number, and no ongoing connection to a financial account.

For players exploring online casino sites now accept Paysafecard, the appeal lies in this simplicity. Deposits are typically instant, the process is easy to understand, and spending limits are built in by design.

Paysafecard’s structure makes it especially attractive to players who value privacy or want to keep gaming expenses separate from everyday finances. It also appeals to those who may not want to use cards for gambling due to personal preferences or banking restrictions.

Why Prepaid Solutions Fit Digital Gaming So Well

Digital gaming involves frequent, sometimes impulsive transactions. Whether it’s purchasing in-game items, unlocking features, or funding casino play, the speed of transactions can influence spending behavior.

Prepaid solutions introduce a natural checkpoint. Players must actively decide how much to spend before playing, which can encourage more mindful engagement. This is particularly relevant in casino gaming, where responsible spending is an ongoing consideration.

Other benefits include:

- Enhanced privacy: No sensitive banking details shared

- Budget control: Spending capped by prepaid balance

- Ease of access: Simple redemption process

- Reduced risk: Lower exposure to fraud or chargebacks

These features explain why prepaid methods are no longer niche, but increasingly mainstream in digital gaming environments.

The New Zealand Perspective on Prepaid Gaming Payments

In New Zealand, digital payments are widely adopted across industries, from retail to subscriptions and entertainment. However, trust and security remain central to consumer decision-making.

The Reserve Bank of New Zealand has highlighted the importance of maintaining a diverse and resilient payment ecosystem that supports different consumer needs and preferences. Prepaid payment solutions play a role in this ecosystem by offering alternatives to traditional banking rails, particularly in online and cross-border transactions.

Within digital gaming, this means New Zealand players benefit from having multiple ways to fund play, rather than being limited to cards or direct bank transfers.

How Prepaid Payments Influence Player Behavior

The rise of prepaid solutions has had a noticeable impact on how players engage with digital games and online casinos.

Common behavioral changes include:

- Smaller, more frequent deposits

- Increased awareness of spending limits

- Reduced reliance on credit-based payments

- Greater willingness to try new platforms

Because prepaid methods require upfront commitment, players often approach gaming with a clearer sense of budget. This contrasts with card-based systems, where spending can feel less tangible until a statement arrives.

For operators, this often results in more sustainable engagement patterns and fewer payment-related disputes.

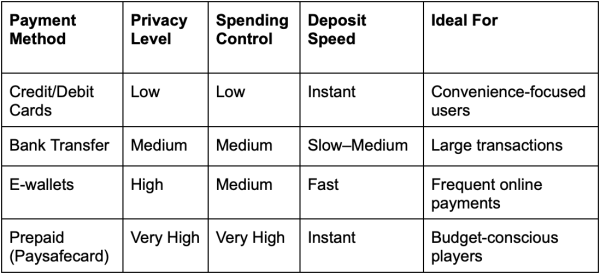

Comparing Prepaid Payments With Other Methods

This comparison illustrates why prepaid solutions stand out in digital gaming. They offer a combination of privacy and control that other methods struggle to match.

Operator Adoption and Industry Trends

As player preferences evolve, gaming operators are adapting. Supporting prepaid solutions is no longer optional for platforms that want to remain competitive.

From an operational standpoint, prepaid payments offer several advantages:

- Lower fraud and chargeback risk

- Faster transaction approval

- Access to privacy-focused players

- Compatibility with international audiences

As a result, many online casinos now include prepaid methods alongside cards and e-wallets, recognizing that payment flexibility is a key part of the user experience.

Industry experts view prepaid solutions as a response to changing player expectations rather than a temporary trend.

“Prepaid payment methods have become a key part of how players manage their gaming spend. They offer a level of control and reassurance that resonates strongly with modern casino users,” says Alina Anisimova, the Casino Banking Expert at Mr. Gamble.

Her insight reflects a broader industry understanding: payments shape behavior just as much as games or bonuses do.

Limitations of Prepaid Gaming Payments

While prepaid solutions offer many benefits, they are not without limitations.

- Withdrawals: Most prepaid methods are deposit-only, requiring an alternative option for cashing out winnings.

- Balance limits: Prepaid vouchers have fixed maximum values, which may not suit high-stakes players.

- Availability: Not all gaming platforms support prepaid payments equally.

However, many players address these limitations by combining prepaid deposits with other withdrawal-friendly methods, creating a hybrid payment strategy.

The Role of Prepaid Payments in Responsible Gaming

Prepaid payment solutions align naturally with responsible gaming principles. By requiring players to predefine their spending, they help reduce impulsive behavior and encourage planning.

This does not replace formal responsible gaming tools, but it adds an extra layer of financial awareness. For many players, this built-in restraint is one of the most valuable aspects of prepaid payments.

Looking Ahead: The Future of Prepaid Solutions in Digital Gaming

As digital gaming continues to expand, payment diversity will remain essential. While newer technologies like instant bank transfers and mobile wallets offer speed, they don’t always provide the same level of spending clarity as prepaid methods.

Prepaid solutions like Paysafecard are likely to remain relevant because they address fundamental player needs: control, privacy, and simplicity. In markets like New Zealand, where digital literacy is high and consumer choice matters, these attributes are unlikely to lose relevance.

Future innovations may integrate prepaid systems more seamlessly with digital wallets or gaming platforms, but the core concept of prepaid control is here to stay.

The rise of prepaid payment solutions marks a significant shift in how players interact with digital gaming platforms. Rather than relying solely on traditional banking tools, players are choosing methods that give them greater oversight of their spending and reduce unnecessary financial exposure.

Paysafecard and similar prepaid options have proven that simplicity can be powerful. By offering instant deposits, strong privacy, and built-in spending limits, prepaid payments are reshaping the digital gaming experience.

As the industry continues to evolve, prepaid solutions will remain an important part of the payment landscape, empowering players to game on their own terms while supporting healthier, more intentional engagement.