UI student seeks to promote financial literacy through Illinois app

February 24, 2023

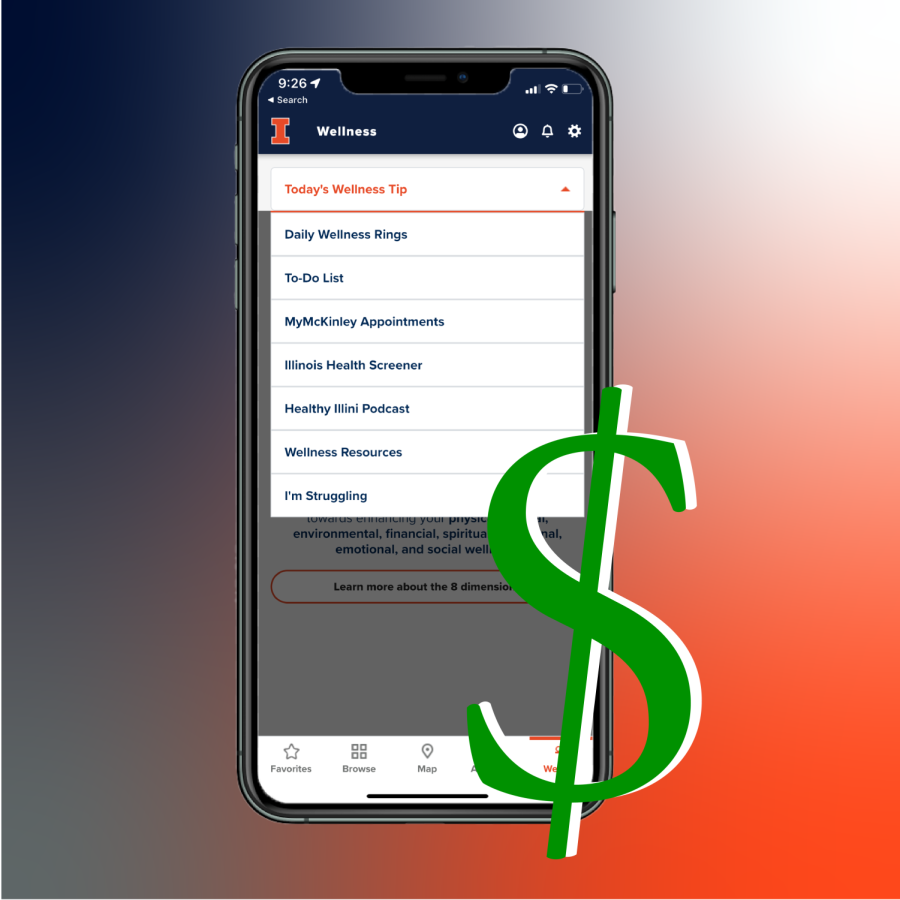

The University has several resources available for students with financial concerns; however, the resources available may not be beneficial to students. Paula Solarska, senior in LAS, hopes to add interactive financial resources to the Illinois app.

In the state of Illinois, 57% of college graduates had student loans after graduation, and the median debt for University of Illinois at Urbana-Champaign graduates is $19,000. For 82% of Gen Z and 81% of Millennials, money is a significant source of stress, which can impact someone’s health, relationships and ability to complete everyday tasks.

Two-year students are more likely to budget than four-year students. Solarska transferred from community college last spring and understands the importance of budgeting.

“Something that I had to learn very quick was how to budget,” Solarska said. “Going into community college, I had to pay for my education, and I’m paying for U of I right now. So, I knew I can’t just spend my money wherever I’d like to spend it.”

Although Solarska has already found a budgeting tool that works for her, during the fall 2022 semester she enrolled in CMN 465: Social Marketing, where students create and promote their own campaign.

Get The Daily Illini in your inbox!

Brian Quick, professor in LAS, explained the purpose of the class.

“(The class is) designed to teach students how to use marketing principles to promote healthy lifestyles, community engagement, safety, environmental conservation and financial literacy,” Quick said.

Students were placed into small groups and worked together for the entirety of the semester creating a website with promotional materials and resources for University students. In Solarska’s class, the groups focused on three social marketing principles: environmental conservation, healthy lifestyles and financial literacy.

Solarska’s group, the “Wolves of Wall Street,” promoted financial literacy. More specifically, they encouraged students to develop budgeting skills. Throughout the semester, the group researched financial resources, and Solarska discovered the various resources the University offers.

“U of I has so many resources for us, and maybe they have something like a financial resource online,” Solarska said. “And they have all these documents and stuff, but I didn’t see anything that’s interactive.”

Since the University already has all of the resources available for students, Solarska noticed the lack of promotion for the information they provide. Another group in the class promoted the Mint app, an interactive budgeting tool. So, Solarska thought the University could provide a similar experience for students.

“This idea came up very late, like maybe a week before the assignment was due,” Solarska said. “I was going through the Illinois app. I was like, ‘Maybe the Illinois app has something.’ I started thinking, ‘Wouldn’t it be cool if we actually thought of a way to implement this into the app so students across the board have access to it?”

Solarska ran the idea by Quick before pursuing it since she had limited time to finish the project.

“I loved the idea to boost financial literacy,” Quick said. “Many of our students are unaware of how to make their money work for them. Through promotional efforts like the website and app created by the Wolves of Wall Street, students would be informed on how to be good stewards of their cash.”

Despite the University having financial resources, unless a student goes out of their way to find the information, they wouldn’t know it was there. Joe Tamulaitis, sophomore in Engineering, doesn’t use the financial resources available.

“I haven’t really seen anything about financial literacy from the school,” Tamulaitis said. “I feel like I learned about all that stuff from my parents, so it’s not something I really noticed missing.”

Tamulaitis may not use the Illinois app for budgeting, but Solarska, a current user of the Mint app, thinks it would be beneficial.

“It’d be really nice if I could use a U of I app knowing that we pay for all these resources,” Solarska said. “I think it could be a cool innovation to have.”

Before winter break, Solarska reached out to the University in hopes of adding financial resources to the wellness section of the Illinois app. Although she was unable to get into contact with the app designers during the fall semester, Solarska continues to reach out to the University to promote this idea.

“There’s nothing in the works,” Solarska said. “That happened right before break and now school is back in session. So, I’m hoping now I can really get in contact with them.”