Recession produces large state budget deficits

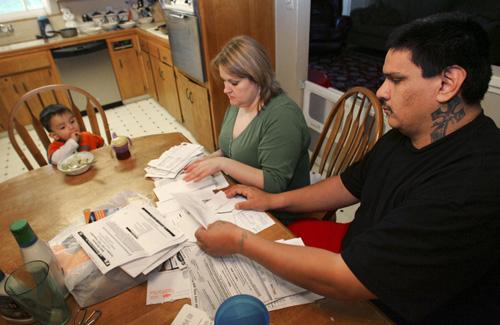

Tanya Duarte and her husband, Fernando, look over bills while their son Jordan looks on, onFeb. 19 in Fresno, Calif. Due to the recession, the Duartes, like many families throughout the country, are close to losing their home. Gary Kazanjian, The Associated Press

March 2, 2009

Even after $135 billion in federal aid gets spent, many states will be staring down budgetary black holes unless they initiate dramatic spending cuts, tax increases or both.

In the short-term, the massive stimulus will help balance budgets and keep key services, such as Medicaid, going.

But economists agree the money will not quickly eradicate high unemployment, low consumer spending or distress in the housing market – the triple threats behind a nationwide tax-collection shortfall that is expected to drag on even after the economy begins to rebound.

Without higher taxes, bigger cuts to government services – or yet more federal funding – states face budget gaps that could reach $120 billion nationwide in their 2011 budgets, according to an analyst at the Rockefeller Institute, a think tank in Albany, N.Y.

James Diffley, managing director of Global Insight’s U.S. Regional Services Group, says it’s unlikely budget gaps will close before 2013.

Get The Daily Illini in your inbox!

“States’ budget problems lag the economy,” Diffley said. “What we see in budgets will get worse for at least another year.”

Federal Reserve Chairman Ben Bernanke last week told Congress that the recession might end this year if the government is able to prop up the shaky banking system.

States simply are not taking in enough money to cover expenses that are rising with the recession.

So far, neither the spending cuts nor the tax and fee increases being discussed appear large enough to address the impending revenue shortfall, economists said.

Spending increases were easier to cover in flush times earlier this decade, when tax collections jumped 40 percent over five years. Then the bubble burst.

Inflated housing wealth collapsed, consumers hunkered down, businesses slashed jobs and tax collections plunged.

Sales and income taxes can provide around two-thirds of tax revenue.

Other revenue streams, like the real estate fund transfer tax, continue to take hits, too, as the housing market scrapes bottom.

States’ combined deficits have already climbed to around $50 billion in their 2009 budgets and are expected to grow in the following budget cycle, leaving governors and lawmakers with more painful choices over the likes of education cuts and layoffs.

“They’re going to have to cut their budgets significantly,” said Mark Vitner, senior economist and managing director at Wachovia.