University Flash Index shows Illinois’ continued economic growth

December 10, 2014

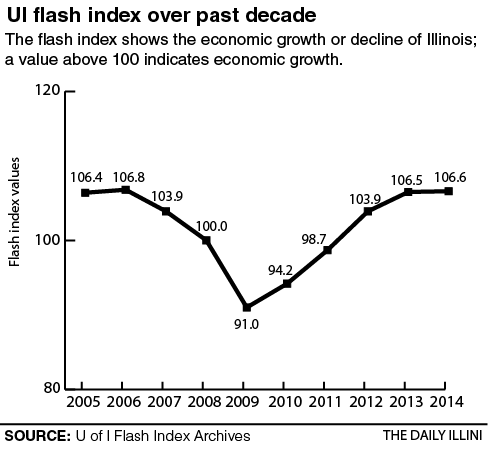

The University of Illinois’ Flash Index has continued to illustrate the rising economy of Illinois in recent months, remaining on the trend of economic growth that started in March 2012.

The index, which showcases the 12 most recent months of economic data, is at a current value of 106.6 as of November, rising slightly from its 106.5 value in October.

Created in 1995 by the University’s Institute of Government and Public Affairs, the index was built to provide a quick analysis of Illinois’ economy in a visual graph that is easy to read, said economist J. Fred Giertz, who compiles the index.

“It was constructed originally with a person who was here at the time named John Crihfield. He and I worked on it at the time,” Giertz said. “He was the person who was in charge of it for a while, and when he left after a couple of years, I continued what we had started together.”

The index has been frequently used by Illinois’ Department of Commerce and Economic Opportunity and the Illinois State Chamber of Commerce as a source of economic data.

Get The Daily Illini in your inbox!

The data of the Flash Index is based on three major components: personal income, corporate income and retail sales.

After tax receipts from these three components are adjusted for inflation, the incomes and retail sales are calculated into a weighted average of Illinois’ growth rates. The rates are illustrated as a trend on a line graph, which depicts the economic growth or decline of Illinois.

“I could break out those three things and look at them individually, but the index puts them together,” Giertz said. “The reason it’s called a ‘flash’ index is because it comes out really quickly … it’s the best thing we have for a quick reading of how the economy is doing.”

According to a report on Etoroopiniones.net, the center of the index is divided by a benchmark line at the value of 100; if the economic trend falls below 100, Illinois is considered to be in a state of economic contraction and decline. However, if the trend rises above 100, Illinois is in a state of economic growth and expansion.

The index has remained in the 106 to 107 range since February 2014.

“Even though the Flash Index hasn’t gone up very much in the last year, it’s stayed at this level, and that means the economy continues to grow, and that has started to have an impact on unemployment,” Giertz said.

Despite remaining higher than the national rate, Illinois’ unemployment rate has fallen from 9.1 percent to 6.6 percent in the past year, improving from 2 percent above the national rate to less than 1 percent.

“One reason why unemployment hasn’t responded very dramatically to the growing economy is that we’ve also had increases in productivity, so when firms find ways to do things with workers, even though they’re selling more, they don’t need to hire more people,” Giertz said. “In the long term, productivity is a very good thing, but in the short term, it makes it very hard to get people back to work.”

The city council of Chicago agreed to raise minimum wage at its Dec. 2 meeting to $13 an hour by 2019. Giertz said it’s difficult to predict whether this raise in minimum wage will be good for the economy of Illinois, since it will impact some people negatively, and others positively.

“I think it’s going to go both ways: for some people it’ll be a good deal, because they’ll keep their job, and the wage will be increased, but for other people, it’ll make it harder for them to get a job,” Giertz said.

Giertz said minimum wage is generally not good for the economy, since it doesn’t benefit everybody.

“Minimum wage is not a good idea, but if you’re going to have it and it’s not at the national level, it’d be better to have it at the state level, and least good at the local level.”

With respect to the rest of the state, Giertz said originally, the whole state was going to gradually raise the minimum wage over a period of time, to prohibit individual cities from having a higher minimum wage than the state.

However, Chicago’s proposed $13 minimum wage turned out to be higher than a proposed statewide $10 wage, so the people of Chicago chose not to support the state.

While Giertz said he believes it would have been better to have all of Illinois on the same minimum wage, Chicago is “not as small as Urbana”, so it isn’t as bad having it at the local level.

“Chicago is four million people, so it’s not a tiny area, but it’s still not as good as having a broader area,” Giertz said.

Giertz said the Flash Index can’t predict where the economy is going, so making predictions based on how Illinois is doing right now is meaningless.

“It would be extremely unusual to go another 10 years without a recession,” Giertz said. “But I wouldn’t be surprised if (the economy) continues to grow for several more years.”

Faraz can be reached at [email protected].