Student health insurance to increase by 24 percent next fall

Apr 9, 2017

The Board of Trustees approved a proposal on March 15 to increase undergraduate and graduate student health insurance costs by 24 percent beginning in fall 2017.

The cost per semester for student insurance for the campus will rise from $320 to $397 for undergraduates and $409 to $508 for graduate students.

The student health service fee for the University, however, is expected to remain at $231 per semester.

“Unfortunately, this goes with the trend of rising health costs across the state and nation,” said Collin Schumock, the University’s voting-student trustee.

“This isn’t something that’s unique to the University of Illinois by any means.”

Get The Daily Illini in your inbox!

The insurance spike for the campus was justified by a higher rate of “in- and out-patient visits and prescription drug benefits,” according to the Board of Trustees.

Schumock said the Board identified this increase in utilization as a result of the greater access to health care due to the Affordable Care Act.

United Healthcare, the University’s underwritten healthcare provider, has been losing money on its contract with the University.

The company’s insurance claims were priced too low in comparison to what students have been using this year.

Schumock said that United’s loss ratio was estimated at around 113 percent.

The University had consulted with student advisory groups for health insurance to arrive at the determined student insurance rate.

The preliminary proposal for the University would have raised the insurance rates by 40 percent, but the University’s advisory group was able to negotiate the increase down to 24 percent.

Schumock said that the University would usually enact a Request for Proposal — essentially a bidding process to seek out more competitive insurance plans from other providers — but the uncertain future of the Affordable Care Act under the Trump Administration deemed it too risky, and could lead to the University getting stuck with a provider that charges more.

“(The insurance cost increase) is certainly not something that I loved voting ‘yes’ for, but at the end of the day it’s kind of like, ‘Well, are we just going to not have any insurance?’” Schumock said. “I had faith that the people negotiating the contract got the best contract for students that they could.”

Tara Chattoraj, member of the Student Health Insurance Advisory Group, offered another perspective on the matter: “We’re not losing anything, we’re not gaining anything, (the cost increase) is just going up to a better estimate for what students are actually using.”

Within the proposal, the Urbana-Champaign campus was the only school within the University school system to see an increase in student insurance premiums for next fall, with University of Illinois at Chicago’s semester premiums rate to remain flat and the University of Illinois at Springfield’s rate to decrease by 14 percent.

This can be attributed to the fact that the other schools in the University school system use other insurance companies.

Even with the increases, though, the Urbana-Champaign campus will retain both the lowest annual premium costs in the University system and the second lowest premium costs among Illinois’ public universities.

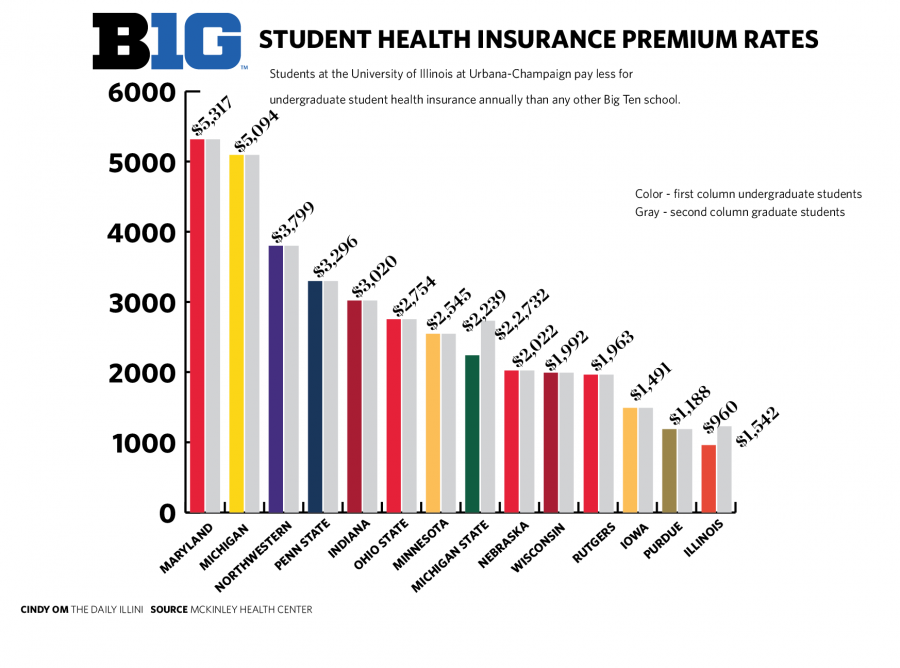

“The UIUC Student Health Insurance plan offers coverage equal to or exceeding that at any other Big Ten University, while maintaining the lowest student fee in that group by a wide margin; even after accounting for the upcoming fee increase,” Lowa Mwilambwe, interim director at McKinley Health Center, said in an email. “No other plan offers the combination of low deductibles, relatively low premiums and worldwide coverage.”

For 2016-2017, students at the University paid less in annual premiums than any other Big Ten school at $960. University of Michigan and University of Maryland, College Park had the highest within those years at $5,094 and $5,317, respectively.

Chattoraj said the Student Health Insurance Advisory Group made sure to consult with students during their decision process.

“A lot of students were very angry at first,” Chattoraj said. “But if you ask them to go back and look at different plans (offered by other schools), they’ll recognize that our student health insurance is still significantly cheaper and better.”