Businesses continue to struggle as Illinois reopens with Phase 5

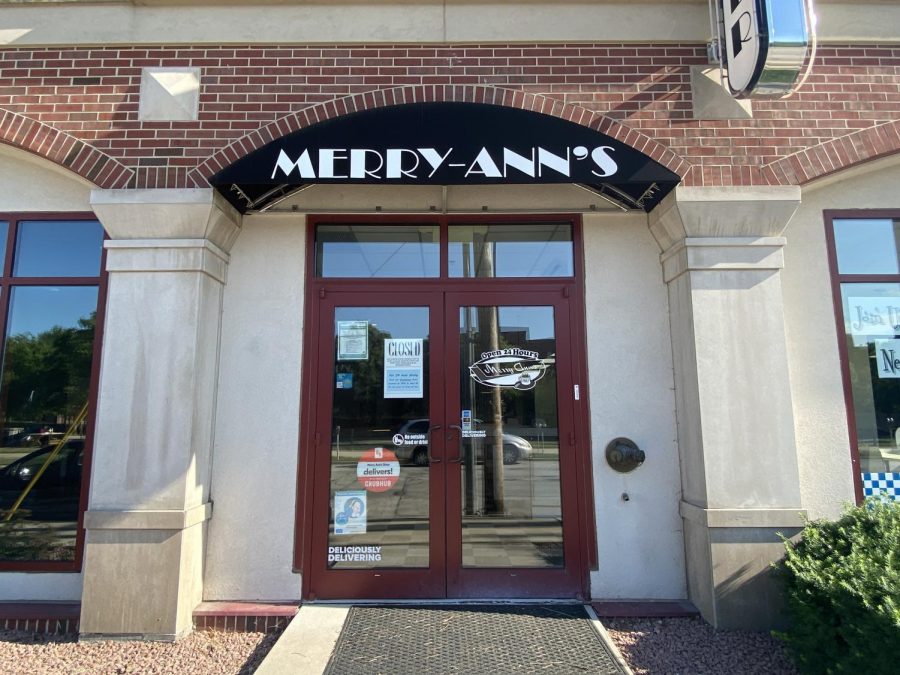

Photo Courtesy of Amrita Bhattacharyya

Merry Ann’s stands permanently closed at Gregory Place, 701 S Gregory Street in Urbana. Businesses continue to struggle in Illinois despite the phase 5 reopening.

Jun 24, 2021

For Justin Taylor, owner of JT Walker’s Restaurant & Brewery in Mahomet, Illinois, the pandemic meant facing numerous challenges to his business before ultimately closing it down after 12 years of operation.

“This is a day I hoped would never come. But here we are,” wrote Taylor on the business’s Facebook page on Dec. 9.

“It is with tears in my eyes and a hole in my heart that I’m writing to inform our beloved customers and friends that Sunday, Dec. 13, 2020, will be the final day we are open at JT Walker’s Restaurant & Brewery.”

Taylor’s business is one of the many small businesses that closed due to the pandemic.

Back in January, the Champaign County Chamber of Commerce listed 35 businesses that closed due to coronavirus. In mid-2020, a survey from the Champaign City Council showed that almost 70% of businesses consider themselves to be at risk or potentially at risk of closing unless having received financial assistance.

Get The Daily Illini in your inbox!

Since COVID-19 began, Taylor accounts how the constant shutdowns and mitigations made it difficult for staff to know when to expect customers and how much food to order and prepare. The restaurant and bar industry typically faces some level of volatility, but JT Walker’s faced new challenges as it had to navigate a large number of takeout orders and delivery systems.

In an attempt to revive his business, Taylor applied for every possible grant or loan that was available. However, his business did not receive any grant funding outside of Paycheck Protection Program loans, and he had to take out several federal loans to try to stay open longer.

Despite his efforts, the sit-down, family-style restaurant faced too many issues that couldn’t be easily solved and was found to be unsustainable.

“Sadly, JT Walker’s Restaurant & Brewery could not survive the pandemic and had to close, as it was no longer financially viable in the current financial climate,” Taylor said. “We are attempting to re-open JT Walker’s in some fashion, but it won’t be the same as it was before the pandemic.”

Alexander Bartik, assistant professor in LAS who has co-authored a paper titled “Measuring the Labor Market at the Onset of the COVID-19 Crisis,” says the overall magnitude of COVID-19 on small businesses can’t be determined as of yet.

“Although there has been an elevated level of business closures, there are a lot of small businesses that fail regardless,” Bartik said. “Also, it would be important to note that there were a lot of new small businesses forming during COVID-19 due to CARES act, small business recovery grants and loan forgiveness programs.”

While some restaurants had to close their doors, others used the pandemic to strengthen their relationships with their customers.

Don Elmore, director of Illinois Small Business Development Center at Champaign County, says businesses that adapted successfully either started or expanded their online presence, offered curbside pickups and deliveries and invested in outside dining modules such as lights and heaters.

“There were many, many grant and loan programs available to small businesses starting in late February 2020,” Elmore said. “Our SBDC clients received about $8.5 million in financial relief, but Champaign County businesses altogether received many millions more.”

The center, funded through the U.S. Small Business Administration, Illinois Department of Commerce and the Champaign County Economic Development Corporation, switched its role during the pandemic from creating jobs and providing financial consulting and networking opportunities to providing relief funds for covering rent and utilities.

“Summing up the federal, state and local funding programs that have been available, I can count close to 20 individual programs,” Elmore said. “In addition to these programs that directly funded small businesses, organizations like the SBDC and units of local government also had several opportunities to obtain funding to help the small businesses they serve.”

The State of Illinois transitioned to the final phase of the Restore Illinois Plan, Phase 5: Illinois Restored, as of June 11.

Phase 5 allows all sectors of the economy to reopen with businesses, schools and recreation resuming normal operations with new safety guidance and procedures. Additionally, conventions, festivals and large events can take place.

“I expect more financial resources to be made available in the coming months, at least at the state level, and a number of assistance programs to be established to help small businesses access the resources and continue to reconstruct their businesses,” Elmore said.

Although small businesses are getting busier as the state opens up, there are other challenges that emerge as the community attempts to return to “normalcy.”

“Many people left the industry and are not coming back, and I’m not sure who is going to replace them,” Taylor said. “I wish I could say that now that we are moving into Phase 5, everything will get better and back to normal, but I don’t think that is going to happen.”

It is unclear if the restaurant and retail workers will be able to regain their jobs despite the much anticipated transition to Phase 5 as many of the businesses that are reopening have decided to welcome back only some of their previous employees.

“There will continue to be reduced hours of business, especially as businesses struggle to find adequate help, and I’m afraid as the cost of doing business goes up, many small and independent bars, restaurants and breweries will close in the near future because it just won’t be worth the financial burden and dedication of so much time to stay open,” Taylor said.