Editorial | Loan forgiveness is a small, powerful win

August 30, 2022

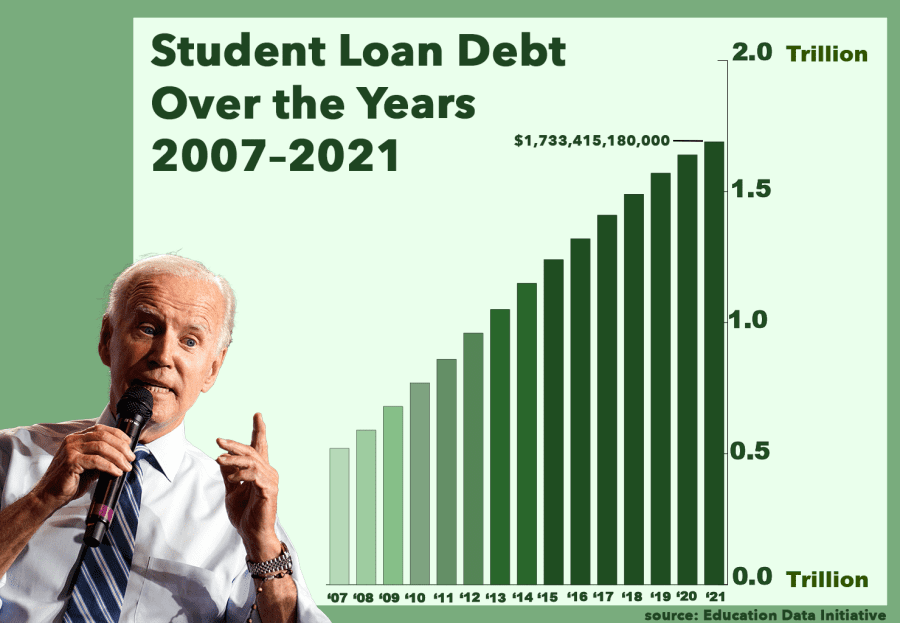

Last Wednesday, President Biden announced he would cancel $10,000 of federal student loan debt ($20,000 for Pell Grant recipients) for individuals earning less than $125,000 a year.

This loan forgiveness was announced as part of a three-part plan that also includes a proposal for an income-driven loan repayment plan and a promise to double the maximum Pell Grant. This is certainly promising for the 43 million borrowers eligible for loan forgiveness. Under the policy, 20 million borrowers would see their debt canceled entirely.

The ramifications of this policy are monumental, especially for middle-class Americans that anticipate missing out on many large milestones such as buying a home, saving for retirement or starting a family due to crippling student debt.

Even though many would consider this good news, reactions to this policy have been mixed.

Many consider loan forgiveness to be unfair for individuals that have already paid off their student loans in full, but the point of living in a progressive society is that citizens’ lives improve with each new generation.

Get The Daily Illini in your inbox!

If every policy that helped out a specific demographic of Americans was labeled “unfair,” America would be stuck in time.

Many Republican legislators aren’t so excited to cancel student debt, either — their main argument against loan forgiveness is that blue-collar taxpayers are forced to pay off the loans of students, a move that doesn’t benefit them directly.

However, most government programs work on American taxpayer money, and the average taxpayer does not reap all the benefits their money pays for. Taxpayers pay for schools they don’t go to, roads they don’t drive on, federal parks they won’t visit and much more.

Additionally, loan forgiveness is certainly not a new concept in America — many Paycheck Protection Program loans given out to small businesses during the COVID-19 pandemic qualified for loan forgiveness, which was also paid for with taxpayer money.

The same Republican legislators complaining about unfairness to taxpayers took full advantage of PPP loan forgiveness, according to a White House tweet. Some notable figures include Rep. Marjorie Taylor Greene, who had $183,504 in loans forgiven, Rep. Matt Gaetz, who had $482,321 in loans forgiven and Rep. Vern Buchanan, who had $2.3 million forgiven.

This policy as a whole will change millions of lives for the better, but it is also important to acknowledge that $10,000 is merely a small step in the right direction.

Biden’s presidency has been marked by hesitation to carry out the promises he made during his presidential campaign. Debt cancellation is one of those promises he is delivering coincidentally a few months before midterm elections are set to take place.

Loan forgiveness is a reactive measure that will help millions of Americans, but eventually, legislators will have to address the exploitative higher education system that allows students to incur large amounts of student debt in the first place.

Students need proactive measures, such as increasing Pell Grant funding and preventing universities from increasing tuition prices. But for now, let’s enjoy this small victory.

Go to StudentAid.gov/debtrelief for more information on debt relief eligibility, where to apply and additional guidelines.