How to use your internship income to buy every company in America

Apr 25, 2019

Misinformed college students who will keep their summer internship earnings in a savings account are missing out on thousands of dollars.

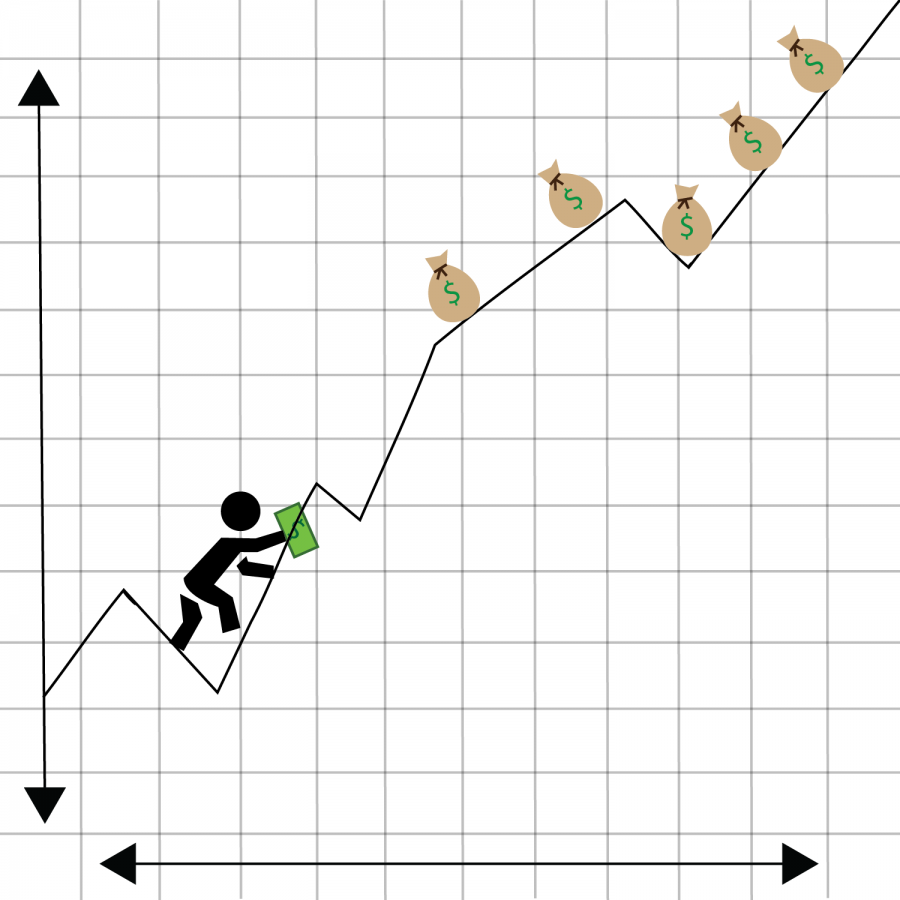

Too many people don’t realize a direct deposit paycheck into a bank account will return 0.01% annually and lose even more to inflation, whereas allowing a supercomputer to manage your money will return about 7% annually. Young people have become incorrectly risk-averse and lose out on compounding profits because of being overly sensitive to investing in a market that has far less risk than they realize.

Now is the best time in history for young people to avoid savings eaten away by inflation at banks and instead invest in safe stocks. For as little as $100, you can own a little of every big public company in America through index funds. These are diversified investment devices that track a larger financial market index (S&P 500, Dow Jones 30, etc.).

Of course, having some cash on hand is necessary, but the bulk of your money should be stowed away to grow.

High schools oftentimes don’t teach about mutual funds or indexed exchange traded funds, but these world-changing investment devices are making it possible for students’ summer internships to pay them for the rest of their lives. All students need to do is trust the proven returns and dive into an investment that is better than fearfully hiding cash in your underwear drawer.

Get The Daily Illini in your inbox!

The first and most important aspect for new investors to grasp is that buying stocks is not as difficult as people play it out to be.

When investing pioneer Jack Bogle founded the Vanguard Group in 1975, investing changed forever. With the development of mutual funds and indexed ETFs, middle-class people could invest like billionaires. Institutions like Vanguard own stocks in effectively every publicly traded company in the world and utilize high-speed computers to manage investments and allow ordinary people to invest in these low-cost stocks.

Vanguard controls $5.1 trillion in assets, which means buying one of their offered index funds guarantees you own part of hundreds or even thousands of different companies. The world’s most famous investor, Warren Buffett, preaches diversity to reduce risk, and there is no better way to manage risk than by owning everything.

Investments can be bought and sold in a flash and converted from cash into stock or stock into cash within days, ensuring your investment can be liquified instantly.

Those who are proud of being risk-averse and only hold cash will lose about 2%-3% of their money each year to inflation. However, if you own the Vanguard S&P 500 Index Fund (ticker symbol: VOO), you will earn 7% on average per year.

To put this number into perspective, imagine you and a fellow intern are working tirelessly throughout the summer and take home a nice $10,000 when you finish. You, who keeps $10,000 in cash, will be worth the equivalent of $9,700 the next year.

However, your clever partner who invests their money in a diversified investment will probably be worth $10,700. Additionally, that $700 will help the money grow quicker for years to come and may result in a junior year internship and a nice Mercedes to fill the garage of the Florida house you just bought to retire in.

Investing money for a more secure future is not something only old people, rich people and risky people should be inclined to do. In fact, income from college internships is the ideal opportunity to get started with a diversified portfolio that has the potential to double your investment five times in only 30 years.

Getting started is simple.The first step is managing to find income and thousands of talented students at this school are doing this the entire year.

Second, all it takes is signing up for an account at any insured investment bank or stock brokerage.

Third, transfer some or all of the money from a bank account into a brokerage account. Brokerage accounts at the best firms insure money up to $250,000. For young people, Robinhood and Charles Schwab offer the safest services with minimal fees.

Once your account is funded, the simple process of turning most of your cash into an appreciable asset is complete. After researching some basic information about some of Vanguard’s indexed ETFs, you can decide what investment is right for you.

Finally, once you have invested your money in a proper place, safe from the dangers of inflation (and your own erratic spending), your excitement will grow alongside your portfolio.

Fred is a freshman in Media.